Amana Bank continues with impressive profits

- 2nd Quarter PAT up by 37%

- 20% growth in Advances with 1.2% NPA

- Total Assets surpass LKR 200 Bn

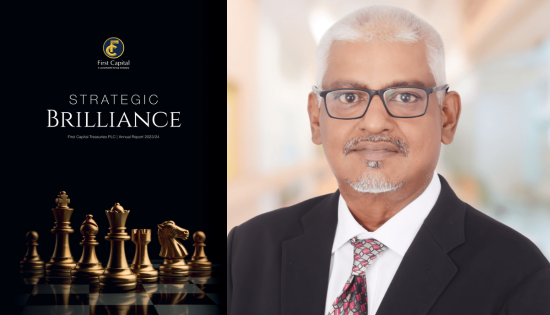

Mohamed Azmeer (Managing Director/CEO Amãna Bank)

Amana Bank continued its strong growth momentum in H1 2025, delivering a solid performance with Profit Before Tax (PBT) surpassing the LKR 1.5 billion mark, reflecting a 14% year-on-year (YoY) increase. Profit After Tax (PAT) also rose significantly by 18% YoY to LKR 901.3 million. For the 2nd Quarter alone, PBT grew by an impressive 29% to LKR 798.6 million, while PAT surged by 37% to LKR 467.2 million.

On the Bank’s top-line performance, Net Financing Income for the first half of 2025 grew by 8% to reach LKR 3.8 billion, supported by a healthy financing margin of 4.0%. A similar growth trend was recorded in the 2nd Quarter, with Net Financing Income amounting to LKR 1.89 billion. The Bank’s Net Fee and Commission Income recorded strong growth, increasing by 59% to LKR 370.2 million in the 2nd Quarter and by 30% to LKR 674.6 million in H1 2025. This contributed to Total Operating Income rising to LKR 2.35 billion in the 2nd Quarter and LKR 4.73 billion in H1, translating to a growth of 14% and 7% respectively.

Fuelled by enhanced portfolio quality, improved operating environment and proactive customer engagement, the Bank achieved a 59% YoY reduction in Impairment Charges, resulting in a 12% increase in Net Operating Income to LKR 4.59 billion in H1 2025. Maintaining a cost to income ratio of 52%, the Bank went on to record a 16% growth in Operating Profit before all taxes to close at LKR 2.1 billion. The Bank’s aggregate tax contribution of LKR 1.21 billion accounted for a significant 57% of the Bank’s Operating Profit before all taxes.

Building on the momentum of advances growth in Q1 and supported by the rising demand for non-interest-based banking, the Bank recorded a commendable 20% or LKR 22.7 billion increase in customer advances during H1 2025 to close at LKR 134.1 billion, whilst setting an industry benchmark with advances consisting of 67% of Total Assets. This performance was achieved while continuing to have one of the lowest industry-wide Stage 3 Impaired financing ratio of 1.2% owing to the Bank’s effective risk management and underwriting standards, driven by its unique people friendly and development focused approach. The Bank’s deposits grew by LKR 15 billion to close the quarter with LKR 169.3 billion while maintaining an industry best CASA ratio of 44%. During the six-month period, the Bank surpassed the LKR 200 billion strategic milestone in Total Assets, closing at LKR 200.5 billion as of 30 June 2025, thereby becoming one of the fastest banks in the country to reach this landmark.

The Bank’s Return on Equity and Return on Assets stood at 7.8% and 1.6%, respectively. Further, Amana Bank’s Common Equity Tier 1 ratio closed at 13.2%, whilst Total Capital ratio was at 15.4%, well above the regulatory minimum requirement of 7% and 12.5% respectively.

During the quarter, Amana Bank was globally recognised as the ‘Most Impactful ICD Investee Company of the Year’ at the IsDB Group Private Sector Forum Awards 2025. This prestigious accolade—awarded among investee companies from 57 IsDB member countries—was a remarkable achievement, especially given that Sri Lanka is not a member state of the IsDB group. The accolade was bestowed recognising Amana Bank’s substantial contributions to Sri Lanka’s economic development, particularly through the empowerment of SMEs and other enterprises during challenging times, while also fostering job creation, advancing financial inclusion, promoting sustainability, and delivering meaningful CSR initiatives.

Commenting on the Bank’s quarterly performance, Chairman Asgi Akbarally said: “Amana Bank’s consistent and resilient performance reflects the strength of our unique banking model and the trust our customers and stakeholders place in us. Surpassing LKR 200 billion in Total Assets in a short period is a significant milestone, and we remain committed to supporting the nation’s economic progress through inclusive and sustainable financial solutions.”

Also sharing his thoughts, Managing Director/CEO Mohamed Azmeer stated “We are pleased with our continued performance during the first half of 2025, especially the strong growth in profitability, advances, and customer deposits. Our development-focused approach, prudent risk management, and emphasis on empowering people and businesses have been key to this performance. Receiving global recognition from the IsDB Group further reinforces the meaningful impact we continue to make, not just financially but socially as well. We look ahead with confidence to build on this performance in the second half of the year, as we remain committed to enabling growth and enriching lives.”

Amãna Bank PLC is a stand-alone institution licensed by the Central Bank of Sri Lanka and listed on the Colombo Stock Exchange with Jeddah-based IsDB Group being the principal shareholder of the Bank. The IsDB Group is a ‘AAA’ rated multilateral development financial institution with a membership of 57 countries. Testifying its position as a leading practitioner of the non-interest based banking model, Amãna Banks was recognized amongst the Top 25 Strongest Islamic Bank’s in the World by The Asian Banker.

Amãna Bank does not have any subsidiaries, associates, or affiliated institutions apart from its engagement with OrphanCare as its Founding Sponsor.

Related News

NDB WriztPay Wins Excellence in Innovation Award at Global Banking & Finance Awards 2024

National Development Bank PLC (NDB) is proud to announce that its revolutionary NDB WriztPay offering has won the prestigious Excellence in Innovation—Payments…

Read MoreNDB Bank Honoured as Bank Partner of the Year at Asia Trusted Life Agents & Advisors Awards 2024

(Pictured L to R) Zeyan Hameed, VP, Branch Network Management & Product Development, NDB; Sanjaya Perera, SVP, Personal Banking & Customer Experience,…

Read MoreOrient Finance Expands Reach in Eastern Region with New Branches

Orient Finance Kaluwanchikudy Branch Orient Finance PLC, a leading financial services provider, has strengthened its presence in the Eastern region with the…

Read MoreJanashakthi Life Posts 45% Growth in Premiums & Other Operating Revenue Surges 111%

Janashakthi Life, a leading life insurance provider in Sri Lanka, is pleased to announce exceptionalfinancial results for the first-half of 2024. The…

Read MoreFirst Capital Treasuries Recognized Globally for Outstanding Industry Leadership and Reporting

Sachith Perera - Chief Executive Officer - First Capital Treasuries PLC First Capital Treasuries PLC (FCT), a leading non-bank primary dealer, continues…

Read MoreNewswire

-

Two Women Arrested at Sri Lanka Airport for Smuggling Anthurium Plants

ON: February 7, 2026 -

22-hour water cut in parts of Kandy District on Sunday

ON: February 7, 2026 -

Dasun Shanaka says pitch conditions will change batting trends at T20 World Cup

ON: February 7, 2026 -

21-Year-Old Man Beaten to Death with Cricket Bat in Ratmalana

ON: February 7, 2026 -

Sri Lanka to Establish New Police Division to Tackle Cyber Crime

ON: February 7, 2026