NDB posts strong profitability in first half of 2024 – PBT crosses Rs. 6.5 Bn

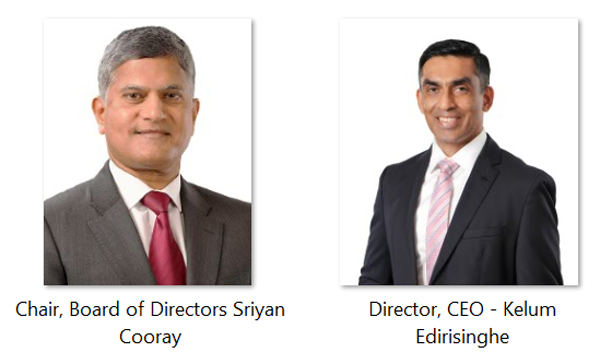

National Development Bank PLC continued to demonstrate strategic agility and resilience amidst less than conducive operating conditions, as was reflected in financial performance for the six months ended 30 June 2024, released to the Colombo Stock Exchange recently. The Bank posted a pre-tax profit of Rs. 6.5 Bn for the period under review, an impressive growth of 58%, predominantly driven by healthy net interest income. NDB’s Director/ Chief Executive Officer Mr. Kelum Edirisinghe attributed such performance to alignment to the Bank’s current mid-term strategy, delivered by the passionate and dedicated NDB team. Our strategy is one which has been curated pivoting around three core focus areas viz. optimising cost of funds, enhancing fee based income through transaction banking and enhancing portfolio quality. This strategy will enable us to drive profitability and enhance shareholder value, helping the Bank reach and exceed its true potential. We are encouraged by the recent affirmation of the Bank’s credit rating at A-(lka) by Fitch Ratings Lanka Limited. As the operating environment continues to stabilise, we remain well-disposed in supporting our clientele and the wider economy with our full suite of financial and advisory solutions, he further commented.

Analysis of financial performance

Income and Profitability

The Bank recorded a total banking revenue of Rs. 22.9 Bn for the period under review, a solid growth of 24% over the comparative period in 2023 (YoY). Net interest income posted a healthy 10% growth to Rs. 16.5 Bn, commendable in the low interest rate environment that prevailed through the period. The decline in the Bank’s interest income was more than offset by the reduction in interest expenses, on account of faster repricing of the deposits book. Net interest margin (NIM) reached an all-time high of 4.26% a growth of 29 bps over the end 2023 position affirming the effectiveness of the Bank’s strategy.

Net fee and commission income for the period was Rs. 3.4 Bn which normalised over a relatively high base in 2023, as reflected in an 8% YoY decline. Other non-fund based income categories all performed well netting a gain of Rs. 3.9 Bn, save and except for those classified as Other Operating Income, which recorded a loss of Rs. 779 Mn on foreign revaluation reserves - attributable to the appreciation of the Sri Lankan Rupee.

Impairment charges for the period was Rs. 8.4 Bn, a YoY increase of 7% versus the comparative period. Impairment (Stage 3) to Stage 3 loans Ratio improved to 44.33% from 41.11% in 2023, reflecting continued build-up of impairment to absorb potential losses in Stage 03 category, as a part of the Bank’s prudent credit risk management efforts. Impaired Loans (Stage 3) Ratio was 7.68% a consistent improvement from 8.58% of financial year 2023, demonstrating the soundness of the Bank’s focused recoveries measures.

Strong cost disciplines, together with enhancements in income enabled a cost to income ratio of 34.9% for the period under review, well within the target level of 35.0%. Total operating expenses was Rs. 8.0 Bn, a YoY increase of 23% mainly driven by increase in personnel expenses due to annual revisions to staff emoluments. As was in the first quarter of the year, the increase in the Other expenses category which comprises manageable costs was well contained, at 9% YoY.

Taxes netted Rs. 3.3 Bn, with a resultant post tax profitability of Rs. 3.2 Bn, which was a notable YoY growth of 37%.

Balance Sheet Performance, Liquidity and Capital Adequacy

The Bank’s Balance Sheet, resilient and well diversified closed in at Rs. 764 Bn as at end June 2024. Within total assets, gross loans to customers grew by 2% over the end 2023 position (YTD) to Rs. 505 Bn, reversing the negative growth trend experienced over the last five quarters. Customer deposits followed a similar trend growing, although at a marginal 1% to Rs. 619 Bn. Rupee deposit base grew by 4% YTD with marked improvement in current and savings deposits, benefitting CASA. Foreign currency deposits declined by 8% YTD predominantly attributable to exchange rate appreciation.

Investor KPIs and regulatory ratios

Return on average equity and annualised Earnings per share for 1H 2024 were 7.38% (Group: 7.58 %) and Rs. 12.52 (Group: Rs. 13.67) respectively. Pre-tax Return on Average Assets was 1.39% (Group: 1.50%) and Net asset value per share was LKR 170.55 (Group: LKR 181.54).

Regulatory Liquidity Coverage Ratio (Rupee), Liquidity Coverage Ratio (All Currency) and Net Stable Funding Ratio stood well above the regulatory minimum requirement of 100% at 284.31%, 262.09% and 143.28% respectively. Tier I and Total Capital Adequacy ratios by the end of 1H 2024 stood at 11.09% (Group: 11.64%) and 14.83% (Group: 15.28%), above the regulatory minimum levels of 8.5% and 12.5% respectively. Prudent measures adopted in balance sheet management enabled the Bank to maintain sound liquidity and capital adequacy. The Bank will raise up to LKR 10 Bn in Tier II capital via Basel III compliant listed, rated, unsecured, subordinated, redeemable debentures during the year with requisite regulatory approval, towards which shareholder approval was obtained in early August 2024. The funds are to be raised with the objectives of improving and further strengthening the capital adequacy ratio in line with the Basel III guidelines and facilitating future expansion of business activities of the Bank.

Outlook

The Bank remains committed to driving sustained bottom line performance and enhancing shareholder value. The mid-term strategy will guide the Bank in this regard. In its course of business NDB will also prioritise on the well-being of all other connected stakeholders and the economy at large, by deploying perfected commercial and development banking expertise available to its credit.

Related News

NDB WriztPay Wins Excellence in Innovation Award at Global Banking & Finance Awards 2024

National Development Bank PLC (NDB) is proud to announce that its revolutionary NDB WriztPay offering has won the prestigious Excellence in Innovation—Payments…

Read MoreNDB Bank Honoured as Bank Partner of the Year at Asia Trusted Life Agents & Advisors Awards 2024

(Pictured L to R) Zeyan Hameed, VP, Branch Network Management & Product Development, NDB; Sanjaya Perera, SVP, Personal Banking & Customer Experience,…

Read MoreOrient Finance Expands Reach in Eastern Region with New Branches

Orient Finance Kaluwanchikudy Branch Orient Finance PLC, a leading financial services provider, has strengthened its presence in the Eastern region with the…

Read MoreJanashakthi Life Posts 45% Growth in Premiums & Other Operating Revenue Surges 111%

Janashakthi Life, a leading life insurance provider in Sri Lanka, is pleased to announce exceptionalfinancial results for the first-half of 2024. The…

Read MoreFirst Capital Treasuries Recognized Globally for Outstanding Industry Leadership and Reporting

Sachith Perera - Chief Executive Officer - First Capital Treasuries PLC First Capital Treasuries PLC (FCT), a leading non-bank primary dealer, continues…

Read MoreNewswire

-

Police slams Irresponsible Media Coverage of Seatbelt Regulations

ON: July 5, 2025 -

Over 5,000 Dengue Risk sites identified

ON: July 5, 2025 -

“Reincarnation of the Dalai Lama Is Not Any Individual’s Call”

ON: July 5, 2025 -

Perpetual Treasuries suspension extended

ON: July 5, 2025 -

18 injured after fire alert on Ryanair plane (Video)

ON: July 5, 2025