First Capital Holdings PLC reports robust first half year performance with Profit after Tax of Rs. 3.43 Bn

First Capital Holdings PLC (the Group), a subsidiary of JXG (Janashakthi Group) and a pioneering force in Sri Lanka’s investment landscape, announced a stellar performance for the six months ended 30th September 2025, recording a Profit after Tax of Rs. 3.43 Bn, a substantial increase from Rs. 897 Mn in the corresponding period of the previous year. “This performance reflects the Group’s disciplined strategic execution, agile response to market dynamics and continued leadership across key segments of Sri Lanka’s capital markets,” stated Managing Director/Chief Executive Officer, Dilshan Wirasekara, commenting on the results.

The Group’s Net Trading Income before Operating Expenses for the 1st half of 2025/26 stood at Rs. 5.46 Bn, compared to Rs. 1.88 Bn in the same period of the previous year, underscoring the strength of its diversified business model and its ability to capitalise on favourable market opportunities.

During the period under review, a moderate decline in interest rates was observed following the reduction in the monetary policy rate in May 2025, despite marginal upward pressure on Government Securities yields towards the end of the second quarter. This monetary stance fostered positive conditions for trading activities, particularly within the equity market. Consequently, the Primary Dealer and Corporate Dealing Securities divisions emerged as the largest contributors to the Group’s overall trading income.

The Group’s Primary Dealer division reported a Profit after Tax of Rs. 1.57 Bn for the first six months ended 30th September 2025, compared to Rs. 578 Mn in the previous year. The results include a trading gain on Government Securities amounting to Rs. 1.81 Bn and net interest income of Rs. 988 Mn (1st six months of 2024/25 – trading gain of Rs. 396 Mn and net interest income of Rs. 834 Mn).

The Corporate Finance Advisory and Corporate Dealing Securities divisions delivered a Profit after Tax of Rs. 1.81 Bn for the six months ended 30th September 2025, a substantial increase from Rs.264 Mn reported in the 1st six months of previous year, reflecting the growing demand for strategic financial solutions and the Group’s continued focus on creating value for its clients and stakeholders.

Meanwhile, The Wealth Management division reported a Profit after Tax of Rs. 48 Mn for the six months ended 30th September 2025 (1st six months of 2024/25 – Rs. 49 Mn), with assets under management (AUM) standing at Rs. 99 Bn as of 30th September 2025 (31 March 2025 – Rs. 112 Bn).

The Stock Brokering division recorded a Profit after Tax of Rs. 116 Mn for the six months ended 30th September 2025, compared to Rs. 6 Mn in the corresponding period of the previous year, a clear indicator of renewed investor participation and improved market sentiment.

In recognition of the strong performance, the Board of Directors of the Company declared an interim dividend of Rs. 7.00 per share, amounting to Rs. 2.84 Bn for the year 2025/26 in October 2025.

Commenting on the performance, Rajendra Theagarajah, Chairman of First Capital Holdings PLC stated, “Our performance this year reflects the effectiveness of our strategy and the strength of our people. We continue to navigate a rapidly changing market with clarity and conviction, driving sustainable growth while delivering long-term value to our stakeholders. The results reinforce our confidence in the fundamental opportunities within Sri Lanka’s capital markets and our resolute commitment to deepening our contribution to the country’s financial ecosystem.”

Adding perspective on the Group’s forward-looking outlook, Dilshan Wirasekara, Managing Director/Chief Executive Officer of First Capital Holdings PLC, said, “Each of our business segments continues to demonstrate strong operational momentum, supported by strategic agility and a culture of innovation. We remain focused on strengthening our leadership in the capital markets space, leveraging our expertise to help investors and institutions unlock long-term value and opportunity.”

Adding to this positive momentum, the Lanka Credit Rating Agency Limited (LRA) upgraded the Company’s credit rating to ‘A+’ from ‘A’, with a stable outlook, reflecting strengthened financial strength and market confidence. This upgrade reflects First Capital’s sustained profitability, sound capital structure, robust governance and strategic leadership in Sri Lanka’s evolving capital market landscape.

First Capital Holdings PLC reinforces its position as a trusted market leader, leveraging expertise, innovation and strategic insights to drive sustainable growth.

Related News

NDB WriztPay Wins Excellence in Innovation Award at Global Banking & Finance Awards 2024

National Development Bank PLC (NDB) is proud to announce that its revolutionary NDB WriztPay offering has won the prestigious Excellence in Innovation—Payments…

Read MoreNDB Bank Honoured as Bank Partner of the Year at Asia Trusted Life Agents & Advisors Awards 2024

(Pictured L to R) Zeyan Hameed, VP, Branch Network Management & Product Development, NDB; Sanjaya Perera, SVP, Personal Banking & Customer Experience,…

Read MoreOrient Finance Expands Reach in Eastern Region with New Branches

Orient Finance Kaluwanchikudy Branch Orient Finance PLC, a leading financial services provider, has strengthened its presence in the Eastern region with the…

Read MoreJanashakthi Life Posts 45% Growth in Premiums & Other Operating Revenue Surges 111%

Janashakthi Life, a leading life insurance provider in Sri Lanka, is pleased to announce exceptionalfinancial results for the first-half of 2024. The…

Read MoreFirst Capital Treasuries Recognized Globally for Outstanding Industry Leadership and Reporting

Sachith Perera - Chief Executive Officer - First Capital Treasuries PLC First Capital Treasuries PLC (FCT), a leading non-bank primary dealer, continues…

Read MoreNewswire

-

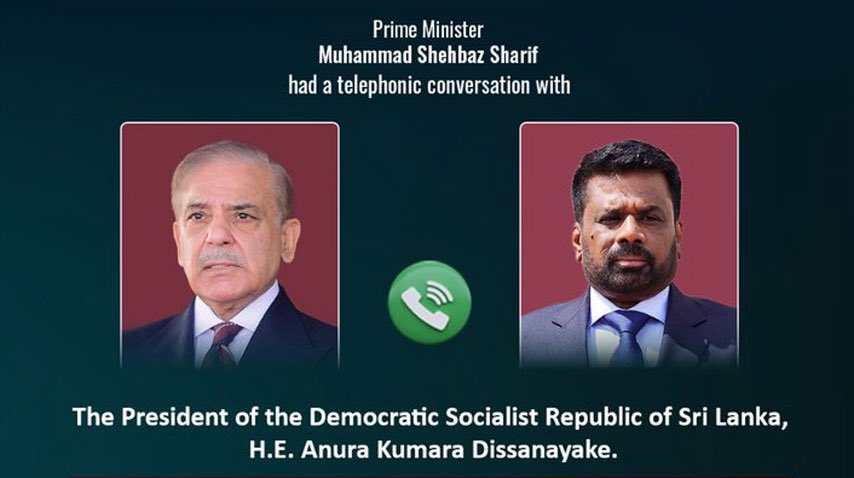

President AKD thanks Pakistan PM as India–Pakistan match confirmed

ON: February 9, 2026 -

Breaking: Pakistan Govt gives permission to play India Vs Pakistan

ON: February 9, 2026 -

India vs Pakistan: Sri Lankan President AKD speaks to Pakistan PM Shehbaz Sharif

ON: February 9, 2026 -

Pakistan & Bangladesh: Statement from ICC

ON: February 9, 2026 -

Breaking : Bangladesh asks Pakistan to play India

ON: February 9, 2026