Janashakthi Life soars Q3 with 249% surge in profits and 72% growth in New Business Premiums

Janashakthi Life, the flagship brand of JXG (Janashakthi Group) closed Q3 2025 solidifying its performance and growth momentum as one of Sri Lanka’s fastest-growing life insurers. Building on the strong progress established in the second quarter, the Company continues its upward trajectory with exceptional gains in profitability and business expansion, surpassing industry benchmarks across key performance indicators.

The Company recorded a 72% year-on-year increase in Regular New Business, reaching LKR 1.227 billion. This growth was driven by an enhanced focus on customer acquisition, customer retention, product diversification and an expanding distribution network. Janashakthi Life also achieved a commendable 249% increase in net profit, amounting to LKR 2.793 billion as at the end of September 2025, compared to LKR 800 million in the same period last year. Total assets grew to LKR 41.508 billion, underscoring the company’s strong financial foundation and prudent capital management.

The Company recorded a claim payout totalling LKR 2.603 billion during the said period honouring its commitment to its policyholders and reinforcing Janashakthi Life’s expanding customer base and its growing market share within the life insurance sector. The Company is further investing in its digital infrastructure for swift and accurate services to its valued policyholders.

Speaking on the Company’s performance, Annika Senanayake, Chairperson of Janashakthi Insurance PLC, stated, “Our strong Q3 performance reflects the strategic focus and governance framework that guide the decisions we make. The affirmation of our A- credit rating by Lanka Rating Agency is proof of the trust we have built, the stability of our business model and the disciplined execution of our long-term vision. We remain committed to driving sustainable growth, maintaining robust governance standards and creating enduring value for our policyholders, shareholders and stakeholders alike.”

Ravi Liyanage, Director/Chief Executive Officer of Janashakthi Insurance PLC, added, “These results reflect the strength of our people and the efficiency of our operations. Through prudent financial management and a clear focus on innovation, we have enhanced returns to our policyholders as well as investors. Our teams continue to deliver excellent results by anticipating customer needs and providing meaningful life insurance solutions that combine protection with value. We are confident that this disciplined progress will sustain our forward drive and reinforce Janashakthi Life’s position as a trusted leader in the industry.”

Janashakthi Life enters the final quarter of 2025 with strong progress and a clear vision to accelerate its growth direction. With a strengthened financial position and a well-diversified product portfolio, the company remains well-positioned to deliver continued value to its shareholders, policyholders and the broader market.

Related News

NDB WriztPay Wins Excellence in Innovation Award at Global Banking & Finance Awards 2024

National Development Bank PLC (NDB) is proud to announce that its revolutionary NDB WriztPay offering has won the prestigious Excellence in Innovation—Payments…

Read MoreNDB Bank Honoured as Bank Partner of the Year at Asia Trusted Life Agents & Advisors Awards 2024

(Pictured L to R) Zeyan Hameed, VP, Branch Network Management & Product Development, NDB; Sanjaya Perera, SVP, Personal Banking & Customer Experience,…

Read MoreOrient Finance Expands Reach in Eastern Region with New Branches

Orient Finance Kaluwanchikudy Branch Orient Finance PLC, a leading financial services provider, has strengthened its presence in the Eastern region with the…

Read MoreJanashakthi Life Posts 45% Growth in Premiums & Other Operating Revenue Surges 111%

Janashakthi Life, a leading life insurance provider in Sri Lanka, is pleased to announce exceptionalfinancial results for the first-half of 2024. The…

Read MoreFirst Capital Treasuries Recognized Globally for Outstanding Industry Leadership and Reporting

Sachith Perera - Chief Executive Officer - First Capital Treasuries PLC First Capital Treasuries PLC (FCT), a leading non-bank primary dealer, continues…

Read MoreNewswire

-

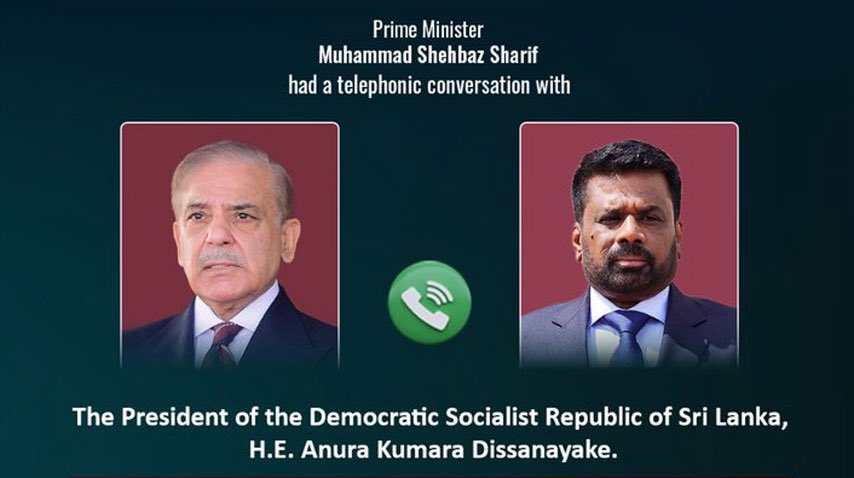

President AKD thanks Pakistan PM as India–Pakistan match confirmed

ON: February 9, 2026 -

Breaking: Pakistan Govt gives permission to play India Vs Pakistan

ON: February 9, 2026 -

India vs Pakistan: Sri Lankan President AKD speaks to Pakistan PM Shehbaz Sharif

ON: February 9, 2026 -

Pakistan & Bangladesh: Statement from ICC

ON: February 9, 2026 -

Breaking : Bangladesh asks Pakistan to play India

ON: February 9, 2026